On Friday, the New Jersey Division of Gaming Enforcement (DGE) posted second-quarter and half-year net revenue and gross operating profits for the nine casinos in Atlantic City. While all were profitable during the April through June period, most casinos showed their profit margins shrinking year-over-year.

Bally’s profit of just $2.3 million represented a 14.7% drop from Q2 2024, though the period was a substantial improvement on Q1.

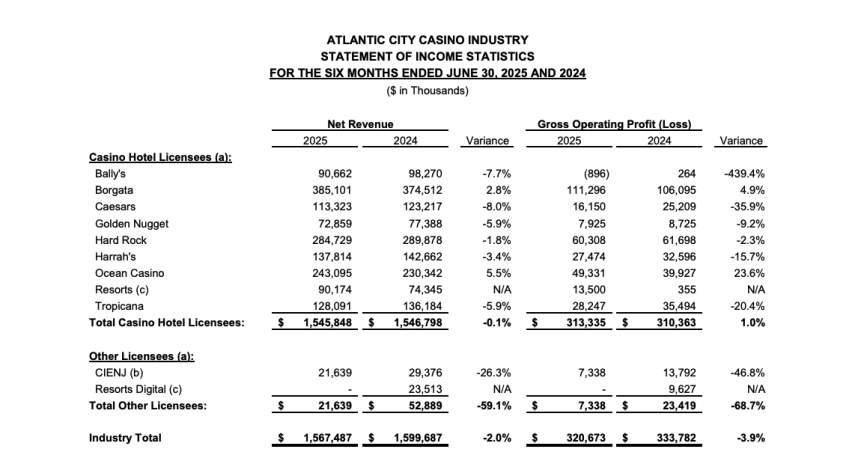

Bally's continues to lose money for the year, with an operational deficit of $896,000 for the first half of the year. According to the DGE, Bally's gross operating profit—a "widely accepted measure of profitability in the Atlantic City gaming industry"—has fallen 439%.

Interest, taxes, depreciation, amortization, affiliate fees, and other ancillary expenses are not included in gross operational earnings.

Bally's Challenges

Bally's is also receiving significantly less revenue per room and hosting fewer customers, according to the New Jersey DGE statistics.

At an average nightly fee of $154, 62% of Bally's 1,121 guestrooms were occupied in 2024. At an average rate of $142, those identical guestrooms were only used 55% of the time through the first half of 2025.

Including gaming, lodging, food, and drink, Bally's net revenue for the first half of 2025 was $90.6 million. That's a 7.7% decrease from a year earlier. In contrast, Borgata, the industry leader, recorded $385.1 million in net revenue. Ocean was valued at $243.1 million, while Hard Rock was valued at $284.7 million.

Bally's needs to move quickly since downstate New York will soon be a new competitor. Few people would probably want to wager on the dilapidated, old property.

Good Elsewhere

The report covers the springtime period before to Atlantic City's summer comeback, even though Q2 indicated tightened profit lines for the most of the casinos along the beach, with the exception of Borgata, which had a 16% profit increase, and Ocean Casino, which saw a 67.9% profit surge.

Brick and mortar casinos reported year-over-year increases in May, June, and July, indicating that gaming revenue has skyrocketed this summer.

Eight of the nine venues were profitable even before the summer boom, and they were able to close the Bally's deficit to claim a 1% industry-wide profit gain for the six months prior. Due to flat income in the first half, the casinos have become more inventive in reducing overhead and raising profits.

"All operators were profitable, despite continuing pressure from higher costs for the goods and services they purchase,” said James Plousis, chair of the New Jersey Casino Control Commission.

The Q2 profit of $179.9 million, according to Plousis, was the second-best in four years.

“Quarterly results from the spring season, coupled with July’s strong monthly figures released last week, reveal that Atlantic City has been competing well for regional gaming and leisure tourists. The casino hotels have raised the bar for positive visitor experiences, with more than $1.1 billion reinvested over the past four years to elevate the properties with first-class gaming, leisure, dining, and entertainment,” Plousis added.

Exclusive Casino Bonuses

Intense Casino

- Mobile friendly design

- The Curacao licensed site

- Limited live chat hours

Play with

Wagering Requirements

-Minimum Deposit

-Welcome offer

up to €888

Deposits

Withdrawals

Other Payment Methods

New players only. T&Cs apply. 18+

Betition

- Offers great welcome bonuses and promos for sports

- Home to leading software providers

- Limited live chat hours 08:00 - 00:00 CET

Play with

Canadian dollars, Chilean pesos, Euros, Norwegian kroner, British pounds sterling, US dollars,Wagering Requirements

Not StatedMinimum Deposit

€ 10Welcome offer 100%

up to € 150 + 150 Spins

Deposits

Withdrawals

Other Payment Methods

New customers only. Minimum deposit: First deposit € 10. Max. Bonus: € 150. Offer applies to the first deposit. Offer only applies to new players. The spins are awarded as follows: 50 spins on book of dead plus a 100% bonus on your first deposit up to € 150. You will receive an additional 50 spins on book of dead when you make your deposit on the second day of at least € 20 and another 50 spins when you make a deposit on the third day (at least € 20). Winnings from games that require a deposit must be wagered 35 times. A bonus that requires a deposit must be wagered 35 times. Terms and conditions apply, see full terms: Bonus Policy 18+ T&Cs and wagering requirements apply.

Oshi

- Home to more than 70+ gaming providers

- Received the AskGamblers Certificate of Trust

- An extensive list of restricted games with bonus funds

Play with

Canadian dollars, Chinese yuan, Euros, Norwegian kroner, US dollars, Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, Tether, Brazilian reals, Ripple, TRON, Russian rubles, Japanese yen, Polish zlotys, Indian rupees, ADA, Binance Coin,Wagering Requirements

-Minimum Deposit

-150% up to €500

& 200 FS

Deposits

Other Payment Methods

Withdrawals

New players only. T&Cs apply. 18+